As I sit at my computer this

morning going through some tweets, I see the former U.S. Senator and

Governor of the Great State of Alaska, Mr. Frank Murkowski, posted an

article about the great opportunity for Alaska and Alberta and Canada. The article is called "Canada's oil is Alaska's opportunity. Franks is, of course, absolutely correct that

Alberta’s oil does represent a great opportunity for Alaska and vice-versa.

I met with Frank and some other political and

business leaders at the Arctic Imperative Summit in Anchorage back in the

summer of 2012. One of the ideas that

were placed on the table was running a pipeline up the MacKenzie valley and

turning left to cross the Yukon and link up with the Trans-Alaska Pipeline

System (TAPS). Another idea is for a

rail connection, a direct link from Alaska to Alberta. I think the rail link is very shrewd.

|

| 3 Amigos Former U.S. Senator & Alaska Governor Frank Murkowski in the center |

When Frank was the Governor, his

vision and that of others, led him to work on a study called “Rails to Resources” that

suggested, years in advance of where we are today, that rail connectivity could

provide both a connection for Alaska to the lower 48 and it could provide a

bi-directional corridor for the flow of goods and services. Wind the clock forward a few years and here

we are today looking at former Governor Murkowski’s vision and wondering why we

didn't see this sooner or do it sooner.

Alaska holds tremendous potential for Alberta insomuch as it is a

natural port of exit for our crude, but with rail, it would create a cost-effective rail corridor that could be leveraged for a lot more than just oil.

At peak output, TAPS flowed more than 2 million barrels of oil a day from the North Slope to the port of Valdez, this peak occurred around 1990. Since then, there has been a steady decline. The pipeline also incurs other issues with declining flow, but the available capacity in TAPS is estimated to be 1.4 million barrels of oil a day. When TAPS falls below 600 barrels of throughput a day, it becomes necessary to mitigate the slower flow of oil and prevent ice formation issues with heat and insulation mitigation methods, below 500 barrels a day will require additional mitigation and when it falls below 400, additional mitigation measures will need to be developed.

The Senator and Governor take another point of view that is interesting;

such a project would create a direct rail link from Alaska to Alberta and the rest of the North American continent. Easements exist from Fort McMurray to Peace

River, but the really critical part is that all the first nations who would

need to be part of an agreement have signed letters of support, even the Assembly of First Nations has signed.

Rail has certain appeals that differ from a pipeline, the infrastructure may be used to ship cargo of other types and even tourists. I’ve always thought that despite the greater greenhouse gas emissions from rail-shipped crude and the slightly higher transportation costs, there will come a day when other forms of energy displace oil. It could be a paradigm shift, there could be successful fast ignition fusion or any number of emerging energy research possibilities in conjunction with existing renewable technologies. Likely, it will wind up being a matrix of solutions, but a pipeline is unlikely to be required for whatever the solution set is. Whatever happens, we do know that tight shale plays are changing the economics of oil, in some ways that are to the advantage of Alberta, and in some ways it is a disadvantage.

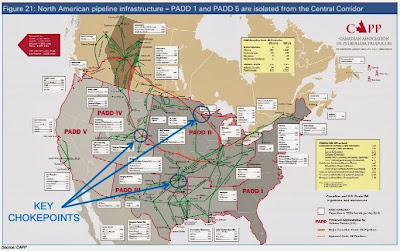

Most people hear the term West Texas Intermediate (WTI) and we think that's what a producer gets for a barrel of oil... not exactly. There are many different types of crude oil. We produce a lot of heavy oil in the oilsands and it requires special equipment to change it from the crude oil we produce into refined petroleum products, whatever they are. Like any system of trade, there are places in the supply chain where oil is delivered, many of us have heard of "Henry Hub" which is one of those places where oil is delivered. There are different areas in the United States where oil goes to be turned into refined products, and during World War II, the U.S. Government had a Petroleum Administration for War that established five districts to ration gasoline. These areas are called Petroleum Administration for Defense Districts (PADD).

Pricing is derived from where the oil is being delivered and, of course, when it arrives at the destination in one of the PADDs where it is going to be refined, it goes into storage. A price is paid based on supply and demand at that site. In other words, if there is a large capacity for refining sour (meaning high sulfur content) or heavy oil, the refinery will want to have that kind of oil... it requires a coker or hydrocracker, fancy words for special technology that costs a lot to install, maintain and operate. Because it costs more than the equipment used to refine sweet light oil (WTI), there is a higher cost associated with the refining process. In turn, the refinery has to account for that cost and the producer receives a lower price, assuming there are no imbalances in supply and demand, which also impacts price like any other commodity.

But there is an issue with supply and demand, and it's growing. In the Gulf States, there is a capacity for heavy oil that has been supplied by areas like Canada with our oilsands, Venezuela oilsands product, or Mexican Maya heavy. The Gulf States these days, however, are awash in light crude oil from the tight shale plays in Texas, the most notable being the Eagle Ford play. So much light crude is coming on the market that there is expected to be a supply imbalance within two years at the rate of new products being brought online. That means there will be more of the light crude than refiners can handle and their heavy oil capacity will remain underutilized unless Canadian heavy oil can be delivered.

This is a figure that shows the expected growth of different types of oils in the five PADD areas of the United States. After all that, it's important to realize that the pricing Alberta producers receive depends on the type of oil they sell, where they deliver it, and the supply/demand conditions that exist at the point where the oil is going. All of this means basically, in a nutshell, two things. First, our heavy oil is selling way below the price of WTI, so when you hear 96 or 100 dollars a barrel, that's not what we're really getting, it can be 20 or 30 (and even more) dollars a barrel discounted. That's a bad thing for our producers and for the government that derives a lot of revenue from the sale of oil.

There is a good story though, it's not all one-sided. As the Texas oil shale plays and plays nearby start to deliver more and more light crude, they may arrive at an imbalance within a few years' time if the added production continues at current trajectories. Less consumption due to greater fuel efficiency, oil replacement strategies, and a greater supply will eventually create a supply/demand imbalance such that the United States may need to actually think about exporting light crude. The U.S. appetite for heavy and high sulfur oil will remain because that's not the kind of oil they produce. This appetite has quantifiable limits in each PADD because of refinery capacity and types of refineries.

It's safe to say that Canadian heavy will continue to be consumed primarily in PADD II because that's where the refineries are that have significant capacity to deal with this kind of oil. It may also be delivered via Keystone to Texas where it would compete with Mexican Maya heavy. But the largest and most equitable market for Canadian heavy is the World market which cannot be accessed without access to the ocean. Because of the price discounts our producers have to take, the Province of Alberta has been losing billions of dollars every year. Not a few million, not tens of millions, but billions in royalty revenue that the Government of Alberta simply does not receive due to this discount.

Alaska literally needs to have oil in its pipeline TAPS in order to prevent it from requiring mitigation to allow the lower production to flow. Alberta needs to stop watching billions of dollars escape our treasury because we have no other customer except the United States. Our good friends in Alaska are willing to work with us and so are the First Nations between our heavy oil and the Pacific ocean. There is nobody standing in our way along that corridor, it already has a deepwater tanker facility plus storage, and there is nothing to do but build a railroad that would connect Alaska to Alberta. Alberta would benefit to the tune of billions of dollars a year and Alaska would benefit financially as well plus there would be a rail connection that meets up with the shortest trans pacific trading shipping route. This means cargo can be part of the equation as well, allowing all kinds of products to move via rail between Alaska and anywhere on the North American continent. There is no doubt the State of Alaska and the Government of the Yukon and the First Nations will work with us.

|

| G7G First Nations |

Our Government of Alberta has funded a G7G study driven by the VanHorne Institute that will determine if it is viable and economically sound to establish such a rail corridor. I have news... the answer is not only yes, but it is yes, and as fast as we can, please. I am not prepared to wait years to hear results... every several billion dollars we lose because we can't take decisive action is a crime against our nation and our children yet to come. We are condemning them to far less than we could give them. I know some will argue that we should produce no oil at all... and they will get in their car and drive to the airport to board a plane to fly to a conference to learn about alternative energy. They will consume products made from petroleum and think nothing of it, just as they will power their computers and lights with coal-fired electricity... because they do not realize that we must pay for a transition to new clean energy. How will we do that? Please answer me because I cannot see a clear answer unless the World is prepared to go with nuclear power. I don't think they are.

|

| Proposed Rail Line to connect to TAPS and Alaska |

Last week a train left China for Europe... it carried freight cargo. I think there's room to think outside the box. I have said on a number of occasions that one day there will come a paradigm shift, and we will not have to use hydrocarbons for energy. Until that day arrives, doesn't it make sense for us to look for the most fuel-efficient ways to move people, cargo, and yes... even energy? Rail infrastructure has been lost in North America, and now we are building it back. A good friend who is a railroader said that "once you give up a line, you won't get it back", and he is right. I remember seeing the old railroad tracks when I was a kid, you could find spikes and remnants of the wood here and there. We used to go play there and make our forts out on "the old railroad tracks". Well here's a chance for us to build a new railroad that would create not only billions of dollars of wealth that we could use to pay it out quickly, but we could also pile money into clean renewable energy research and have a rail line capable of moving anything from across North America to the closes deepwater port on our continent to Asia.

Just the strategic benefit of having that rail in place is more than enough for me to think that ought to be a national priority. Sure, I'd look at building a pipeline too, but I'd much rather have a rail line on that route. Initially, we all talked about a pipeline... but now that I'm very keenly interested in all things transportation, I can see the clear and distinct advantage of a rail connection from the lower 48 through Alberta and into the Yukon and Alaska.

Train from Zhengzhou to Hamburg

I believe that a rail connection solves about 4 million barrels a day worth of oil export capacity, and neatly bypasses the opposition in British Columbia, although that seems to be fading fast as oil by rail starts shaping up to move in every other direction, and it also creates a strategic asset that a pipeline does not. I advocate for both, but at the end of the day, I'd much rather take a high-speed train from Edmonton to Anchorage than fly from Edmonton to Seattle and up to Anchorage. I love Alaska, that's where all my halibut comes from and where some very dear friends live.

|

| TAPS in the Winter |

I just don't think it's much of a choice really. How in the heck am I going to get to Alaska on one of these pipelines? But rail... well that's a very different story. It's time for us to unlock our wealth and put it to good use. Why not open our Arctic up to rail and give the Yukon and Alaska a great ride in the process? It won't take long before people figure out that it's not going to be just for oil, there will be tourists and cargo. The economic boom will completely invigorate the far northern communities in Canada and it will put a jolt of economic boom into Alaska. I think that's almost a no-brainer... but I'll wait to see the economics. That said, somehow I think it all comes back to good old-fashioned common sense. My friend Frank has plenty of it. The brightest economists from the Yukon and Alaskan governments thought this was a good idea without the oil money on the table... but with it. I'd be willing to bet my house on this one.

|

| Lt. Governor Meade Treadwell |

Oh, and yes I did get to know Alaska's Lieutenant Governor Meade Treadwell and I can tell you that he is a great guy, easy to get along with, and I think that he is emblematic of the great people of Alaska... he's the kind of person you can have a straight up honest conversation with. Just the kind of person somebody from Alberta would like to do business with.

To all my friends in Alaska and the Yukon, I support you and I have been advocating for this for quite some time. Seeing Frank's article this morning enthused me to write about this. I really like big thinkers like Frank and Meade. Come to think of it, every person I have ever met in Alaska has been awesome! Having a direct connection to Alaska would be incredible and profitable.

No comments:

Post a Comment